If you could buy something at a discount and immediately sell it for the full price without much effort, would you do it? Participation in an ESPP could end up working out just like that. But as with all tax-related and benefit-related things, the devil is in the details. We are going to go through ESPP timelines, limits on salary deferrals and buying, and tax rules for dispositions of ESPP shares.

What is an ESPP?

An Employee Stock Purchase Plan is a benefit plan run by many publicly traded companies. A qualified ESPP allows employees to buy company shares at a discount (5% to 15%), plus potentially receive a favorable tax treatment when selling those shares.

What are ESPP limits for contributions and purchases?

The IRS set the contribution limit at $25,000 of pre-discounted total annually, but your employer can further restrict that amount. If your plan offers a 15% discount and allows for the full $25,000 limit, then you can contribute up to $21,250 annually. If the discount is 10%, then your contributions limit is $22,500, and so on.

There is also a lesser-known purchase limit on the number of shares you can buy based on the price at the beginning of the offering period (grant date). The fair market value (FMV) on grant date effectively sets the dollar amount per share that will be used to eat away at your max $25,000 annual limit. In other words, the maximum number of shares you could buy during the year is determined on the grant date by dividing the annual limit (say, $25,000) by the FMV on grant date.

Here is an example of how your purchase ability might be restricted with a declined stock price. If the FMV was $100 on grant date, then each share purchased during that offering period would count at $100 towards your $25,000 max, even if that share was actually purchased at a pre-discounted price of $10 due to an unfortunate stock price decline.

If the stock price remained the same or increased from the grant date, then the max number of shares you could buy is indeed determined by how much you’ve accumulated in your ESPP deferral account during the purchase period.

What is a typical discount and how is it applied?

The discount is usually 5-15%, and is set by your employer. Lookback period provisions of most plans allow for buying shares discounted from either the stock price in the beginning of the offering period (grant date) or purchase date, whichever is lower. This can be particularly beneficial for employees of well performing freshly-IPO’d companies during the first offering period.

What is a timeline of an ESPP cycle?

Let’s go through key timeline terms that are important for determining purchase prices and holding periods.

Enrollment Period

During open enrollment you can enroll into the plan and indicate how much in after-tax money you would like to defer into the plan for future purchases of shares on your behalf, up to a maximum allowed.

Offering Period and Grant Date

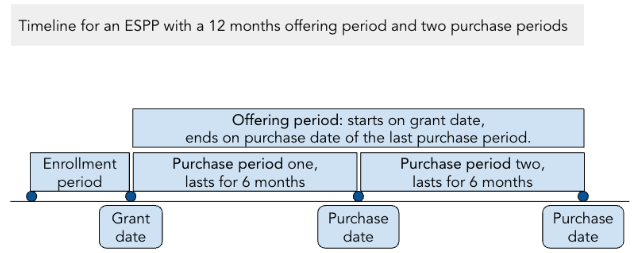

Offering Period is the period of time during which after-tax money is remitted from your paychecks into the plan in preparation for purchase; most common ESPP offering periods are 6, 12, or 24 months long. You can think of this as the length of an ESPP program at a certain price. If an offering period is more than 6mo, it will likely have multiple purchase periods (see below).

Grant date is the first day of the offering period. This is an important date for determining the holding period when chasing lower long-term capital gains rates. The market price of the stock on the grant date is important for calculating the number of shares you will be allowed to purchase in that offering period.

Purchase Period and Purchase Date

At the end of a purchase period, the plan will buy shares on your behalf on purchase date using the funds previously remitted from your paychecks. A plan with a 12 months long offering period will likely have two purchase periods.

Does anything happen taxwise at purchase?

When ESPP shares are purchased on your behalf, there is no tax event. Also, your deferrals into the plan are in post-tax funds, meaning you already paid income tax on it.

Can I sell ESPP shares right away?

Yes, you can sell at your first trading window. If you are seeking to get preferential tax treatment on any gains, then continue reading for the rules.

How are sales ESPP shares taxed when sold at a gain?

When you sell ESPP shares, the sale will be considered either a Qualifying Disposition (tax-favorable) or a Disqualifying Disposition (not tax-favorable) category.

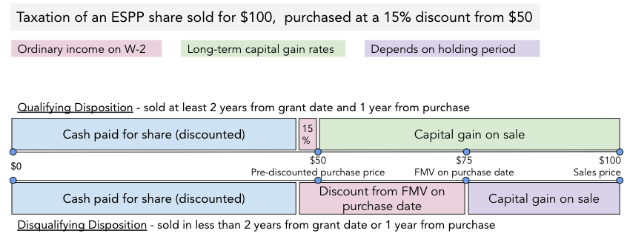

Qualifying Disposition (QD) at a gain: if you sell after 2 years from the beginning of the offering period and 1 year from purchase date, that % discount received from purchase price gets added to your wages; no income tax withholding is required (but tax will be calculated when you file your tax return for that year); the discount is also not subject to FICA taxes. The discount in this favorable case is the actual discount you received from the purchase price, usually 5% to 15%. The rest of the gain above the purchase price is taxed at long term capital gains rates.

Disqualifying Disposition (DD) at a gain: if you sell within 2 years from the offering period and/or 1 year from purchase date, the discount from FMV on purchase date goes into your wages; no income tax withholding is required (but tax will be calculated when you file your tax return for that year); the discount is not subject to Social Security and Medicare tax. Any gain over purchase price is either long-term or short-term capital gain, depending if the shares were held for more or less than 1 year from purchase date.

To emphasize the difference: the discount for DD is calculated by taking the FMV on purchase date minus the actual purchase price, which could be substantial if your shares were purchased at a significant discount by using a lower price from a date in the past using the lookback provision. The discount for a QD is simply the % discount received from the purchase price (in the 5-15% range).

If ESPP shares have large gains or were purchased at a significant discount from FMV at purchase date, then holding them until qualifying disposition terms are satisfied could result in larger tax savings. A possibility of a market price decline is a counter argument for that strategy.

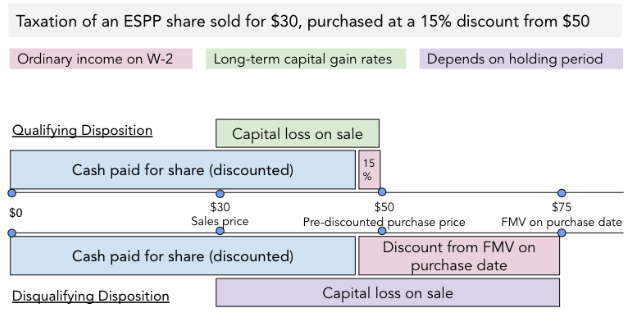

How are sales of ESPP shares taxed when sold at a loss?

Similarly to taxation at a gain, the amount of the discount will be subject to ordinary income tax is dependent on whether a qualifying or disqualifying disposition took place.

A disqualifying disposition at a loss could put you in a position of having to recognize higher ordinary income and higher capital loss, which might not be ideal for your tax situation.

Any other things to keep in mind regarding ESPPs?

Participating in an ESPP with a 15% discount could be seen as a way to potentially get a guaranteed 17.6% return on your investment (if you got $100 worth of shares for $85, that’s a return of 17.6%). A lookback provision might increase that return even further. This return is guaranteed only if you dispose of the ESPP shares immediately after purchase, and if price doesn’t decline before you can sell.

Letting the “tax tail wag the dog” by waiting for a qualifying disposition might bite you in the end, as a sharp price decline might scrap the ESPP tax optimization plan. The textbook answer on ESPPs is full participation with immediate sale to harvest the discount, even at potentially higher tax rates.

Sales of ESPP shares can be subject to lockdown periods. You can, however, mitigate that restriction by including them in your 10b5-1 plan.

Purchasing shares through an ESPP could trigger wash sale rules. If you are selling company shares (say, RSUs) at a loss within 30 days before or after ESPP purchase date, those losses might be disallowed on a share-per-share basis and attached to the basis of the ESPP shares.

A tendency to accumulate an unnecessarily large concentrated position in employer stock can be exacerbated by ESPP purchases without immediate dispositions.

TLDR: You are likely to benefit from participation in an ESPP if you are planning to dispose of those shares right away. If you are planning to keep them, consider your overall position in your employer’s stock and keep in mind the tax benefits of holding the stock for at least 2 years from the beginning of the offering period and 1 year from purchase date (to get to a tax-advantageous qualifying disposition).